estate tax change proposals 2021

July 13 2021. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted.

How The Tcja Tax Law Affects Your Personal Finances

The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018.

. The House Ways and Means Committee released tax proposals to. November 03 2021. This amount could increase some in 2022 due to adjustments for inflation.

November 16 2021 by Jennifer Yasinsac Esquire. Reducing the Estate and Gift Tax Exemption. By Jeffrey G.

One of the plans is reverting the estate and gift tax exemption to 5 million according to a summary of the proposals exposing estates and gifts above that amount. If this proposal were to become. Instead it contains three primary changes affecting estate and gift taxes.

Then the gift and estate tax exemption is lowered from 117 million to 6 million with the gift and estate tax rate increased from 40 to 45 all effective January 1 2022. The taxable estate is transfers ie the estate plus lifetime gifts minus transfers to a spouse charitable transfers certain. Moore Attorney in the Estate Planning Probate Practice Group.

That is only four years away and. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

Then the gift and estate tax exemption is lowered from 117 million to 6 million with the gift and estate tax rate increased from 40 to 45 all effective January 1 2022. The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation. On September 13 2021 the House Ways and Means committee released its proposals to raise revenue including increases to individual trust and corporate income taxes.

Potential Estate Tax Law Changes To Watch in 2021. On Monday September 13. The proposal reduces the exemption from estate and gift taxes from.

Estate and gift tax exemption. Dont leave your 500K legacy to the government. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

The 2021 exemption is 117M and half of that would be 585M. Ad Get free estate planning strategies. The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed. This last week House Democrats released details of a new tax proposal to support the 35 trillion.

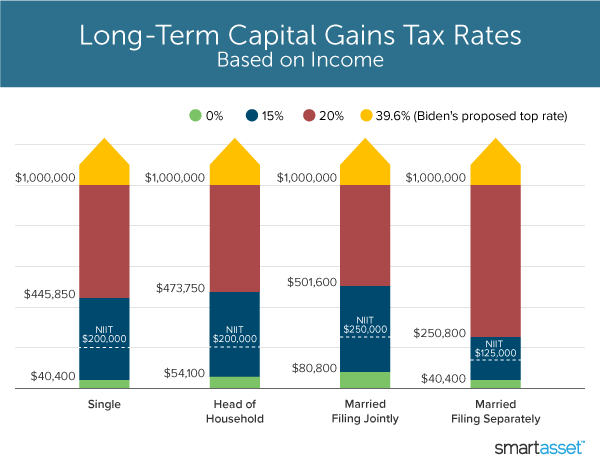

The current 2021 gift and estate tax exemption is 117 million for each US. PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021. Replace the 20 long-term capital gains tax with a 25 rate where total taxable income exceeds.

On September 13 The Ways and. The exemption was indexed for inflation and as of 2021 currently. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure.

Thankfully under the current proposal the estate tax remains at a flat rate of 40. Starting January 1 2026 the exemption will return to 549 million. Reducing the estate and gift tax exemption to 6020000.

No change to the long-term capital gains tax rate. Gifts plus the estate at a 40 rate after deducting an exemption. The estate tax is a one-time tax based on the value of a deceased persons assets as of their date of death if they exceed the estate tax exemption.

The proposal in Congress would cut the. This Alert focuses on the changes that directly impact common estate planning strategies. Proposals to decrease lifetime gifting allowance to as low as 1000000.

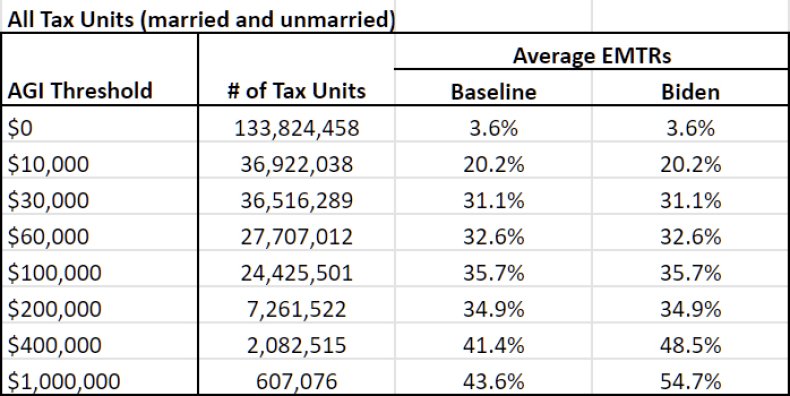

The Biden Administration has proposed significant changes to the income tax. In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Here S How Biden S Build Back Better Framework Would Tax The Rich

Proposed Estate Tax Change May Require You Take Action In 2021 Youtube Estate Planning Checklist How To Plan Estate Tax

Biden Tax Plan What People Making Under And Over 400 000 Can Expect

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Summary Of Fy 2022 Tax Proposals By The Biden Administration

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

It May Be Time To Start Worrying About The Estate Tax The New York Times

What S In Biden S Capital Gains Tax Plan Smartasset

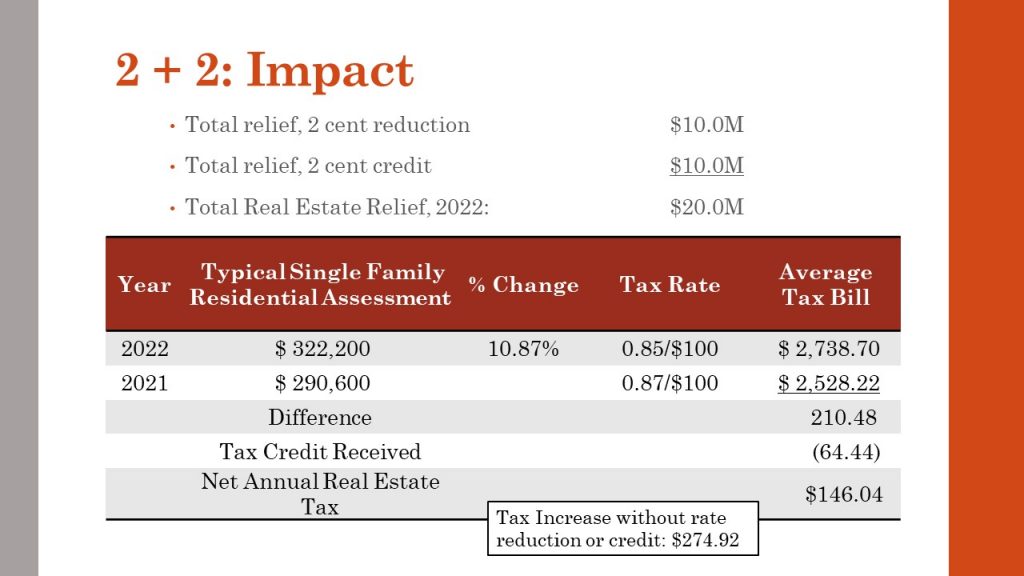

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

President Biden S Stepped Up Basis Tax Proposal Forbes Advisor

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra